If your AR team is not meeting its collection goals, don’t automatically jump to the conclusion that customer AP departments are at fault. It is a popular misconception in AR departments that customer AP departments don’t want to make on-time payments. In reality, AP departments do want to make payments on time to avoid problems with auditing, vendor relationships and cash forecasting.

Often the reason for not being paid on time is the AR department does not realize that an important part of the payment process is missing. Missing steps, documents or pieces of information in the payment transaction cycle can be the reason that you’re getting paid late.

Here are some of the reasons why you may not be getting paid on time.

Wrong Email Address

Emails from your AR department may be going to the wrong email address, and not to your customer’s AP department. AP contacts can change without notice.

Emails Stuck in Spam Folders

Spam filters may be sucking your AR emails into spam folders. Your emails may contain language that trigger spam filters.

Invoices/Statements Mailed to Office

Invoices, statements and correspondence mailed to your customer’s office may be sitting in a pile because the AP department is working remotely. Relying on manual correspondence may cause problems in the new normal.

AP Approval Issues

The AP approval process and issues at your customer may be the reason for delays. There is no one-size-fits-all AP approval process.

Disputes

Customer disputes are often the source of delays in payment. AR departments frequently don’t learn about a dispute until an invoice has gone past due.

Delays Caused by Paper Checks

Payment by paper checks can cause significant delay in payments. Processing time at the customer, mail time, and handling at your company can add up to lengthy delays.

Customer Days Payable Outstanding (DPO) Policies

DPO policies at customers can force delays in payment. Some customers ration or conserve cash with DPO policies that may conflict with your payment terms.

Cash Flow Issues

A number of companies are struggling with cash flow issues as the economy recovers. This is an unfortunate reality that you need to find creative solutions for on a case-by-case basis.

Accounts receivable automation can help to reduce or eliminate the reasons for getting paid late; that are not entirely AP’s fault. Automation makes this possible by eliminating or reducing the road blocks and delays that can cause problems in processing payments. Automation increases efficiency, reduces costs and results in increased profits, cash flow and shareholder value.

Lockstep Collect, a leader in cloud-based credit and collection platforms, can help you collect cash in 4 ways:

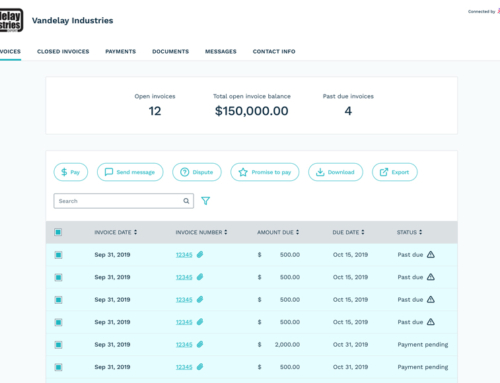

- Cloud-based solutions

- Automated customer communications

- Customer self-service

- Collections Activity Management

Lockstep Collect is an experienced software partner that can help you maximize your collections and cash flow in the new normal.

If you would like to learn more about how you can benefit from automated credit and collection solutions, please contact Lockstep Collect at www.lockstep.io.