Customer disputes are often the reason for late payments. They can be why your DSO is increasing without any good explanation. Disputes are the silent problem that you don’t learn about until well after the fact, when AP pays late and takes an unauthorized deduction or chargeback, or won’t pay at all until a dispute is resolved. By that time, the invoice could already be weeks past due pushing your DSO numbers further out of reach.

Resolving disputes can be difficult and time consuming. The personnel on both sides of the dispute have long since moved on to other problems by the time AR finds out about it. Facilitating a resolution and getting approval for any write off often falls on AR because the problem has flowed downstream to collections. AR usually ends up taking ownership of dispute resolutions by default because of their negative impact on DSOs and cash flow.

Resolution often requires orchestrating internal and external stakeholders with emails and copies of documents to all the participants. It is a thankless but necessary process which does not need to happen in the first place. Here is how to avoid disputes slowing down the payment process.

AP Filed Incorrectly

Something as simple as incorrect filing can put your invoice in the wrong file. This error may never be recognized and the customer’s AP department may not realize that an invoice is past due until a reminder email is received or your AR team follows up.

If your customer uses a manual AP system and pays with paper checks, a simple filing error can take weeks to clean up with document requests, approvals, check processing and mailing, and posting on your end.

Self-Service Portal

Disputes will happen. The key is to provide a tool for early reporting of disputes which can also be used to facilitate a quick resolution. Time is of the essence with disputes. The older they become the more difficult they are to resolve on a timely basis.

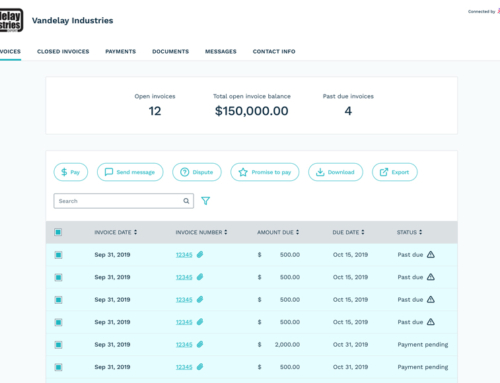

With a self-service portal you can provide a tool for early self-reporting of disputes. A self-service portal with dispute reporting capability provides a platform for quick resolution of disputes. Customers and vendors want the flexibility and convenience of self-service to manage their accounts from anywhere at any time. It is a win-win solution for all stakeholders.

Automation Solutions

AR and AP issues are easier to deal with if you have automated systems. Cloud-based AR and AP solutions with self-service portals and automated processes keep vendors and customers connected no matter where they are located.

Automation can help to reduce or eliminate the reasons for getting paid late. Automation makes this possible by eliminating or reducing the road blocks and delays that can cause late payments. Automation increases efficiency, reduces costs and results in increased profits, cash flow and shareholder value.

Lockstep Collect, a leader in cloud-based credit and collection platforms, can help you collect cash in 4 ways:

- Cloud-based solutions

- Automated customer communications

- Customer self-service

- Collections Activity Management

Lockstep Collect is an experienced software partner that can help you maximize your collections and cash flow in the new normal.

If you would like to learn more about how you can benefit from AR automation, and improve cash flow 31% or more take our AR Automation Product Tour.