Improve cashflow, decrease your DSO and speed up your quote to cash process with accounts receivable automation.

Are you doing the right things to get paid faster?

Download our AR Automation benchmarks report: measuring collections effectiveness. The benchmarks in this report will demonstrate the impact AR automation can have on your collections effectiveness and how embracing technology is key to success.

“What Sage Network allows me to do is manage the full end-to-end invoice-to-cash process, and it provides the flexibility I need to customize the invoicing and collections workflows to meet our ever-changing business needs. With AR automation, real-time integration with the G/L and customer payment portals are table stakes, these are blocking and tackling commodity services. What Sage Network provides is a much more customizable experience that is available in an entry-level platform.”

CFO

CFO

Avenue Insights

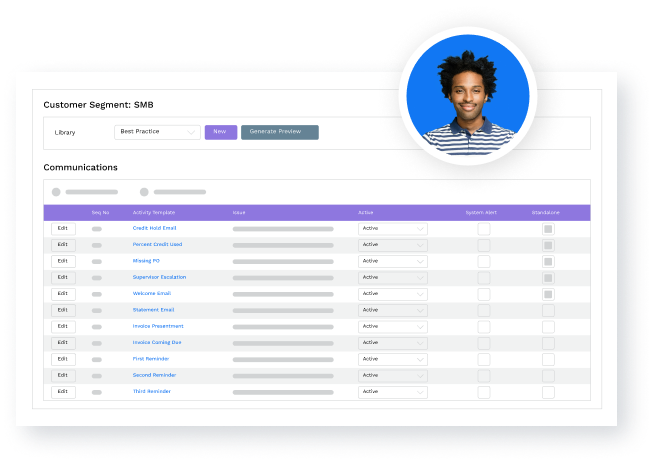

Automated

Customer Communications.

Connect with more customers, faster using automated communications. Optimize your invoice communication workflow by leveraging our best-in-class library of templates and rules that can easily adapt to match your specific requirements across the entire customer lifecycle.

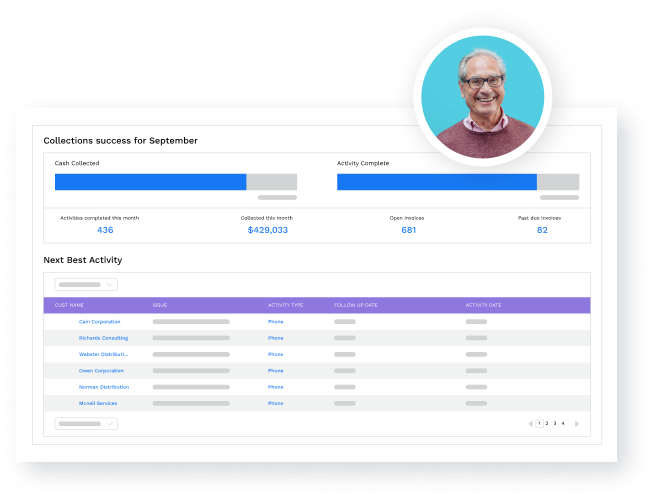

Collections

Activity Management

Connect your team with critical customers and convert trapped receivables into cash. Leveraging an automated next best activity list and a comprehensive view of each customer’s account and collections status, your team can quickly and efficiently resolve payment issues, drastically reducing days sales outstanding (DSO).

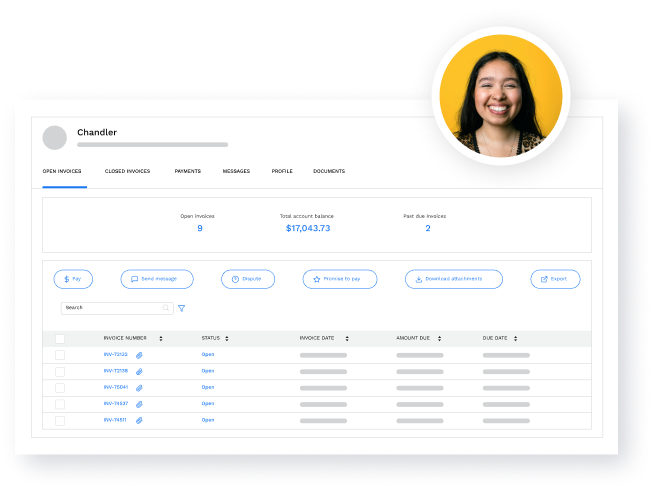

Customer

Self-Service

Connect customers directly to their accounts online to accelerate payment timeliness and accuracy.

Enhance the customer experience and ease-of-use with secure, password-free online account access to manage invoices and account statements, send messages, and increased payment options.

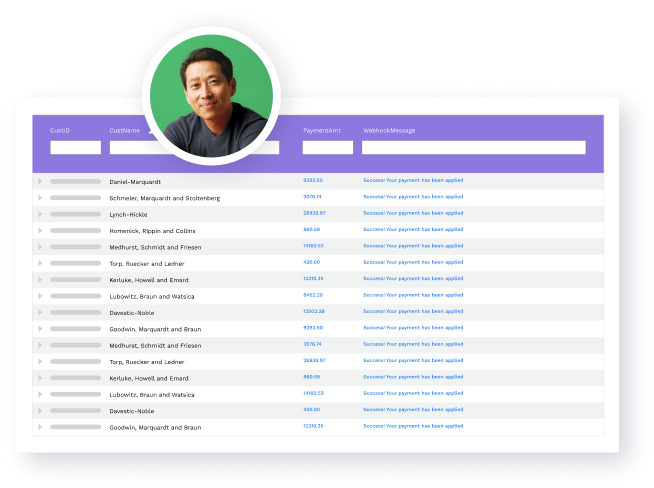

Cash Application

Management

Connect customer remittance to the right invoice automatically, making real-time payments a reality.

Fast-track cash application by automatically aggregating remittance across multiple sources and linking them to the right customers and invoices, putting cash in your accounts faster.

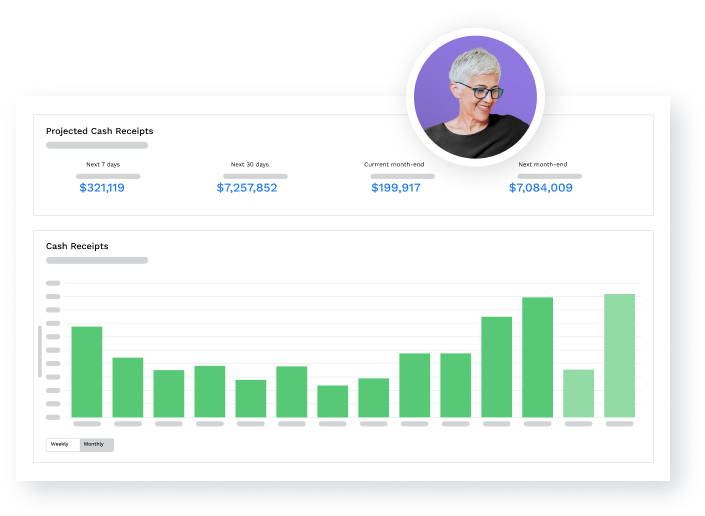

Forecasting

and Reporting

Connect key stakeholders with visibility into cash flow and DSO with custom reports and automated distribution.

Get visibility into cash inflow based on customer payment behavior while monitoring adoption and tracking usage of online accounts and payments.