With a focus on matching accounting team workflows and expectations, we’ve made several enhancements to the way Inbox manages AR and AP Workflows. Among these are the inclusion of credit memos and third-party bill presentment within the application.

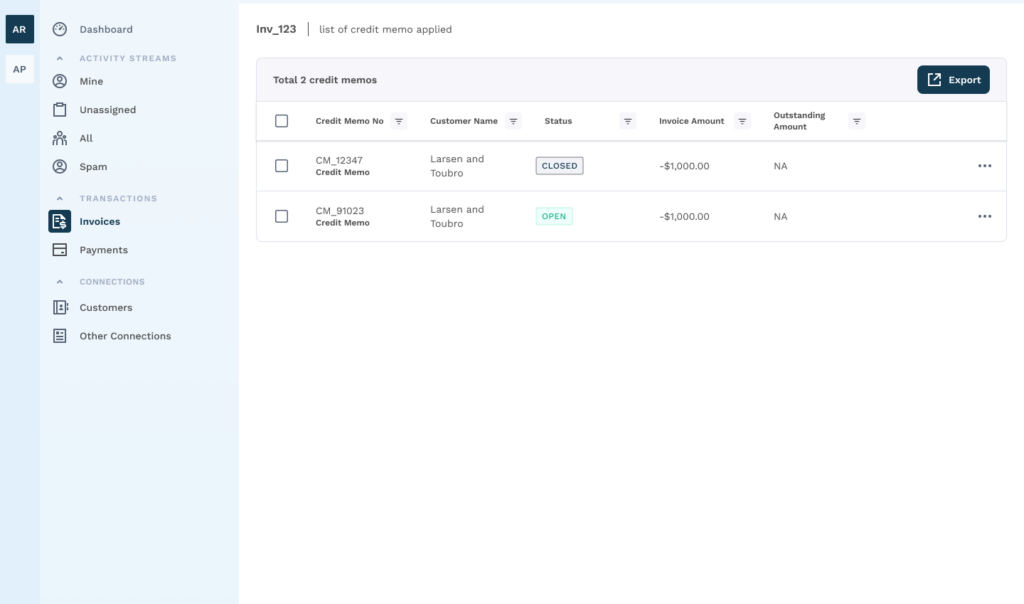

Improved Credit Memo Display

A credit memo is a document issued by a seller to a buyer, indicating that the seller is issuing a credit against a previously issued invoice. This is usually done to correct billing errors, such as overcharging or incorrect pricing. Credit memos are an important tool for accounts receivable teams as they help maintain accurate billing records, reduce disputes with customers, and enhance customer satisfaction. Credit Memos are essential for accurate accounting, and Inbox has taken that notion to the next level. By displaying them in your calculations, you can ensure accuracy of data and analysis with ease!

Additionally, credit memos can also help companies improve their cash flow by reducing the amount of unpaid balances that need to be collected. Credit memos help streamline the accounts receivable process and Inbox’s enhancements make it even easier for AR teams to accomplish their goals. Unlocking an extra level of efficiency, this development is a major boon for accounting professionals everywhere.

This new feature enhances the balance display for outstanding invoices, removing any confusion or discrepancy between Inbox and the User’s ERP. At the same time, Inbox Users can also apply credit memos into their AP workstreams as well to better manage and update outstanding payables. These features allow users to take greater control of their accounts receivable and payable processes with minimal effort.

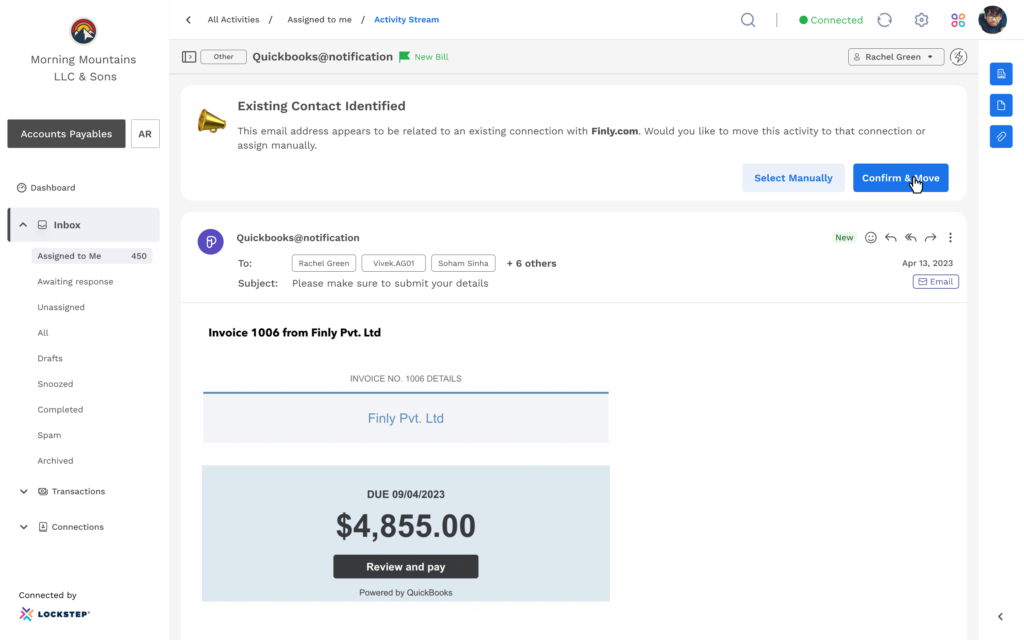

Third-Party Bill Presentment

In addition to improved credit memo display, Inbox now offers the ability for third-party bill presentment within the application. Many accounting systems, like QuickBooks Online, or payment processors, like Stripe, use a generic email address to send invoices (bills) to customers. When multiple vendors use the same accounting system, challenges arise in connecting emails to/ from the correct sender (vendor). With the newest Inbox update, emails and bills sent from QuickBooks Online or Stripe are connected to the proper vendor, saving you time and hassle, having to dig into your data to match the information with an existing data or invoice.

Third-party bill presentment allows companies to receive and view bills from vendors directly within their AP workflow. This has several benefits for accounts payable teams, including faster invoice processing times, fewer payment errors, and increased visibility and transparency over outstanding bills. Additionally, third-party bill presentment can help companies negotiate better payment terms and discounts by providing them with better insight into their spending patterns.

With the newest update, emails and bills sent from QuickBooks Online or Stripe are mapped and connected with the correct vendor. Moreso, if a new vendor employee sends an email with an invoice attached, you can now map this connection to an existing vendor.

By streamlining the accounts payable process and providing greater control, Inbox’s third-party bill presentment is an important tool for accounting teams looking to improve their efficiency and financial performance. This ensures that you can receive bills in a timely manner with absolute accuracy in knowing which vendor is sending them—eliminating any confusion or obstacles along the way.

Whether you’re an AR team looking to streamline your credit memo process or an AP team looking for greater control over bill presentment, Inbox‘s enhancements make it easier than ever for you to take charge of your financial processes. Unlocking unprecedented levels of efficiency for the modern finance professional, this new development is transforming the way AR and AP teams manage their workflows.

Sign up for Inbox today to take advantage of these new AR and AP Workflow enhancements. Streamline your accounting processes with this powerful tool and make the most out of your finances. Unlock unprecedented levels of efficiency with Inbox today!